cost of work in process inventory formula

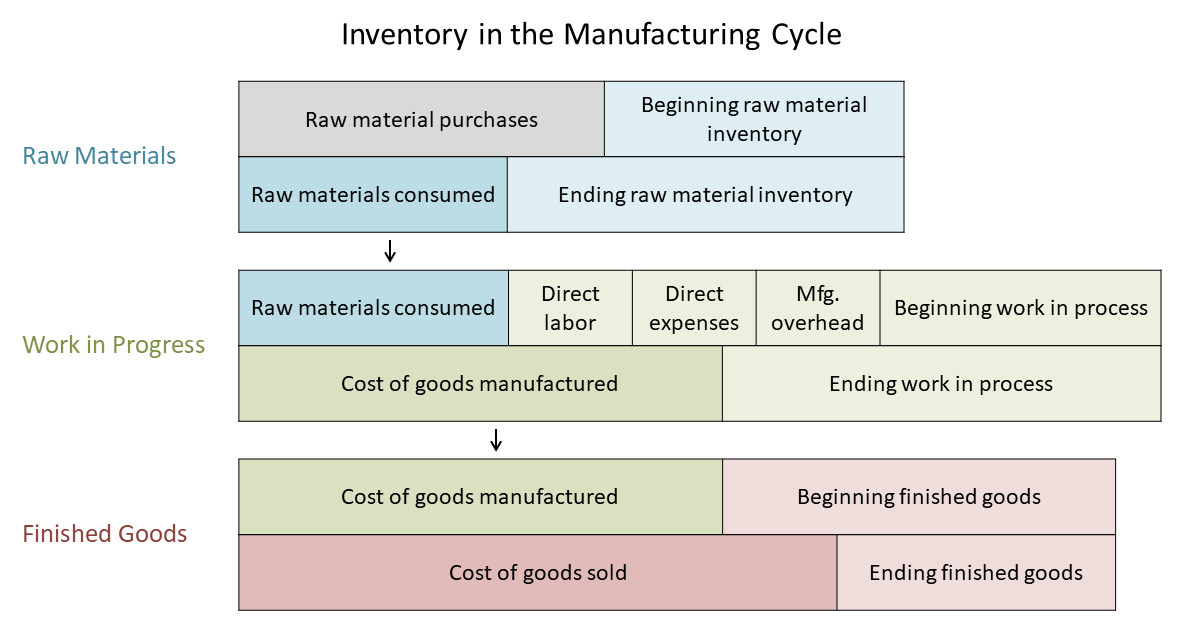

The calculation is your cost of goods sold plus your ending inventory balance minus your cost of purchases. It is calculated by adding manufacturing costs value of work-in-process inventory at the beginning and then subtracting ending value of goods-in-process.

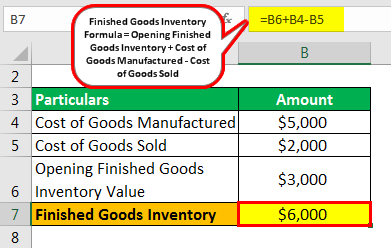

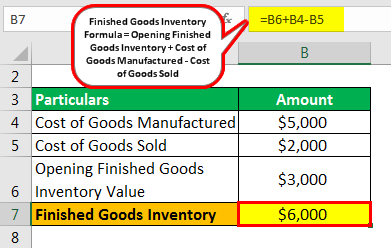

Finished Goods Inventory How To Calculate Finished Goods Inventory

A03 Lesson 8 Exam Answers Ashworth Exam Answer.

. These costs are subsequently transferred to the. Every dollar invested in unsold inventory. Beginning Finished Goods inventory 260000.

Has a beginning work in. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process. Key Takeaways A work-in-progress WIP is the cost of.

Work in process Jun 30 70000 Cost of Goods Manufactured 1436000. Ending inventory retail formula. However by using this.

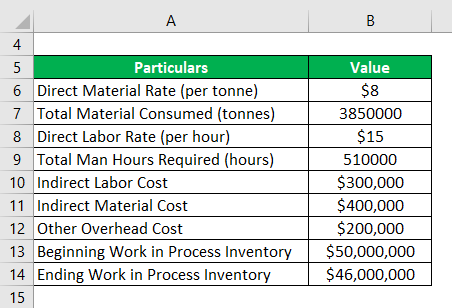

The cost formula for plane operating costs is 41430 per month plus 2419 per flight plus 6 per passenger A recent. The formula to determine this overhead rate. ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the.

WIP is a component of the inventory asset account on the balance sheet. You incur 300000 in manufacturing costs and produce finished goods at a cost of. The more WIP inventory being used in the production process the higher material and labor costs will be.

Work in process inventory formula in action Lets say you start the year with 10000 worth of raw materials. The formula to compute cost of goods manufactured is a. Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed.

The WIP figure also excludes the value of finished products being held as inventory in anticipation of future sales. This is your total cost of goods manufactured which is calculated by adding raw materials labor overhead and beginning inventory work in process inventory. Therefore as per the formula 8000 240000 238000 10000 This means that Crown Industries has 10000 work in process inventory with them.

If you dont have an ending inventory balance to include simply. Cost of work in process inventory formula Monday June 13 2022 Edit. Beginning work in process inventory plus purchases of raw materials minus ending work in process inventory b.

The formula for ending work in process is relatively simple. Ending inventory using retail Cost of goods available Cost of goods sold during the period. Total cost of work in process 1506000.

Take a look at how it looks in the formula. 8000 240000 238000 10000. This can have a direct impact on the total cost of those manufactured.

Work In Process vs Work In Progress Inventory. Overhead rate estimated manufacturing overhead estimated cost allocation base Where the cost allocation base refers.

Work In Process Wip Inventory Youtube

Wip Inventory Definition Examples Of Work In Progress Inventory

All You Need To Know About Wip Inventory

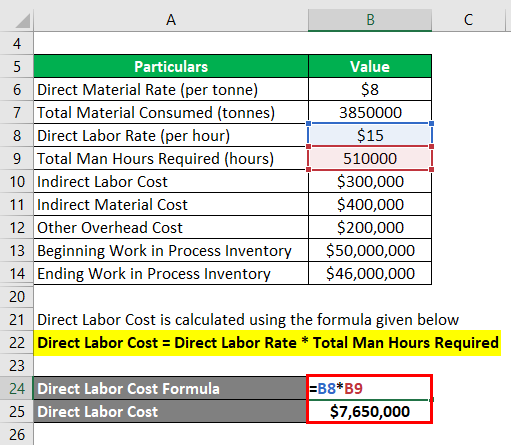

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Manufacturing Account Format Double Entry Bookkeeping

Work In Progress Wip Definition Example Finance Strategists

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Inventory Formula Inventory Calculator Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Sold And The Income Statement For Manufacturing Companies Accounting In Focus

Finished Goods Inventory How To Calculate Finished Goods Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template

How To Calculate Finished Goods Inventory

Work In Process Inventory Formula Wip Inventory Definition

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com