sales tax oklahoma tulsa ok

Allow us to demonstrate our commitment to excellence. Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle.

Peoria Ave Tulsa OK 74105.

. 500 S Denver St Room 205 Tulsa OK 74103 Phone 918596-5100 Fax 918596-4799. Pritzkers budget includes 1B in sales property tax relief By JOHN OCONNOR - AP Political Writer Jan 31 2022 4 hrs ago. Our experienced sales staff is eager to.

10am-4pm Central Park Hall at Expo Square. The excise tax for new. Bill Knight Lincoln in Tulsa OK treats the needs of each individual customer with paramount concern.

If you need access to a regularly-updated database of sales tax rates take a look at our sales tax data page. This page allows you to browse all recent tax rate changes and is updated monthly as new sales tax rates are released. The sales tax rate for the Sooner City is 45 however for most road vehicles there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owners name.

BRINGING TO YOU THE FIRST OKLAHOMA BUILT MANUFACTURED HOME IN YEARS. Call Today for your. Aspen Manufactured Homes 11727 East Admiral Place Tulsa OK 74116.

Over the past year there have been 951 local sales tax rate changes in states cities and counties across the United States. OKLAHOMA CITY City sales tax collections through the first half of fiscal year 2022 are 185 higher than the prior year and 136 above projection. We continue to have extremely strong.

Assessor Tulsa County Assessor Tulsa County Administration Bldg. Search Tulsa County property tax and assessment records through this paid service. LOCALLY BUILT WITH EXCEPTIONAL QUALITY.

Apply Now Registration is open Thursday March 10 2022. If you need your permit faster than the five-day waiting period you must apply in person at the Tulsa or Oklahoma City Tax Commission offices. You need the following information to apply for an Oklahoma Sales Tax.

If you have any questions concerning Oklahoma business licensing or registration requirements please contact the Taxpayer Assistance Division at 405 521-3160. We know that you have high expectations and as a car dealer we enjoy the challenge of meeting and exceeding those standards each and every time. 0 featured_button_text FILE -.

March 2022 Sales Tax.

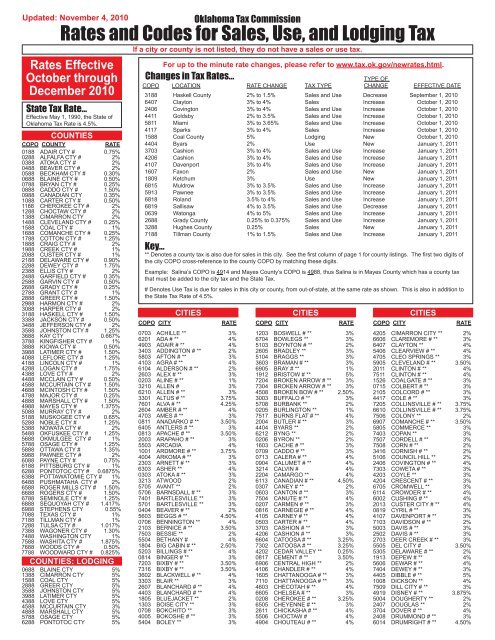

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

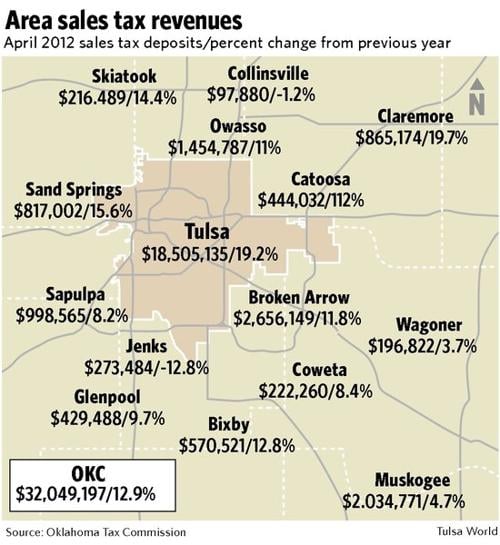

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

How Oklahoma Taxes Compare Oklahoma Policy Institute

Total Sales Tax Per Dollar By City Oklahoma Watch

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms